"I don't have money but I want to buy stocks."In February, the Nikkei average exceeded 30,000 yen, and it seems that many individual investors rushed to "credit buying".

In the United States, a large number of individual investors are running to buy calls and options, causing confusion on the market.

There is a trap in the human psychology that says, "If you go down, you will sell because you are scared, and if you go up, you will be impatient."

However, repeating this will lead to reducing money even if you invest.

信用取引とは、顧客が証券会社に担保として保証金を預け、資金もしくは証券を借りて売買を行う取引のことです。 所定の期限内に、反対売買や現渡しによって弁済をします。委託保証金の約3倍までの売買ができることなどが主なメリットです。

"Credit buying" customers pay the securities company the interest rates for the loaned funds.Customers of "Credit Sales" will pay the securities company for the stock lending fee for the sale securities.Furthermore, depending on the supply and demand status of stocks, a lending fee may be incurred.

「信用売り」に関しては長期で保有している株式が一時的に暴落をしそうという局面でリスクヘッジの効果を出すことが期待できます。

In such a situation, by having a credit -selling ball in such a situation, when the stock declines in the future, it has the effect of offsetting the value of the actual stock and the profit of the selling ball.

決済に関しては、現渡し(保有している株式を品渡しする)方法と、反対売買をする方法があります。

If you want to keep holding the stock price in the long term (or expecting a dividend), you may want to do it in opposition.

In some cases, we want to sell unwritten shares at the falling phase.At that time, it is possible to use credit sales.Institutional investors and intermediate and advanced users can also enter from sale.Then, it is no longer a one -sided purchase, and it can be said that it is a two -sword style.

However, it is unlikely that you can use it very much for "credit buying".Do you want to buy stocks without money or leverage?However, unexpected losses occur if the market moves in the opposite area.

For example, if you buy stocks with a stock price of 1000 yen for a margin trading of 300,000 yen.Transactions up to 1 million yen (1000 shares) are possible.If the stock is sold when the brand falls by 50 % (1000 yen to 500 yen), the loss will be at the risk of loss of 500,000 yen (500 yen x 1000), exceeding the investment amount of 300,000 yen.

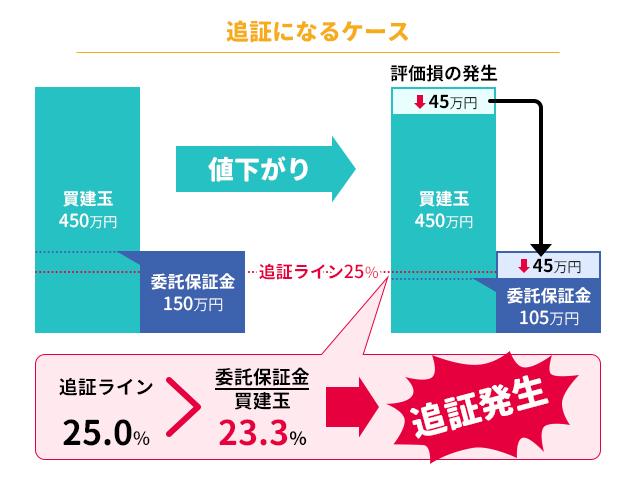

信用取引では最低30万円、委託保証金率が30%以上の両方の条件を満たす必要があります。また、相場の変動等により追加の委託保証金(追証)を差し入れる必要が出ることもあります。必要な担保額(建玉金額に対する委託保証金の維持率25%)を下回った場合には30%以上になるまでの担保を追加で差し入れる必要があります。この追加の委託保証金を「追加保証金、追証(おいしょう)」と呼びます。追証の差し入れ期限は、追証が生じた日の翌々営業日(維持率が20%を下回った場合は翌営業日)までです。

一般に追証発生日より一定期日(起算して3営業日目の正午)までに追加保証金の解消が確認できなかった場合、全ての建玉を反対売買による決済(強制決済)になります。つなり、一番底で投げ売りをせざるを得ない状況になり得るのです。

If you don't have the money but want to buy a stock, you can limit the risk, such as trading in less than a single unit or doing optional transactions (buying call options).There is still the problem that Japan does not have individual stock call options.I would like to explain optional transactions somewhere.

資産運用をする場合、資金管理スキルも一つの投資をする上での必要要件となります。2008年のリーマンショックの際から主に相場を見ていますが、新しい参加者が生まれては資金管理のミスで撤退していくことを繰り返していると感じます。

必ず投資をするなら余裕資金で、信用取引をする場合は証拠金をギリギリではなく多めに入れて置く(投資額の5割程度あると安心)ことが原則です。

The reason for 50 % is that overseas financial institutions can get a loan as collateral, but in the case of stocks and ETFs, it is generally up to 50 %.Financial institutions are calculating that stocks can be halved.

If possible, it is important to invest in stocks as long as the leverage may be gone.If you are worried about the market and you can't sleep at night, or you are worried during work, you will fall over the end unless you are in your main business.